Welcome to part 2 of this series. If you haven’t read part 1, you may want to start here.

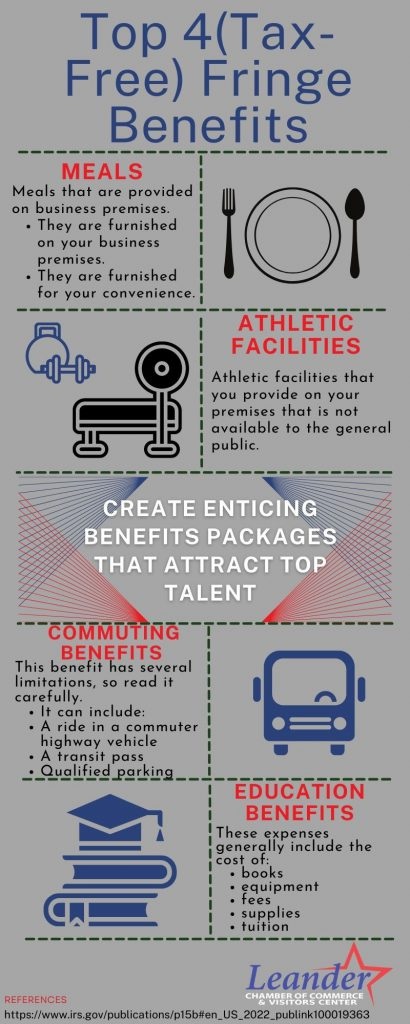

In this post, we want to dive into the four fringe benefits that we have seen create the best employee satisfaction to keep your current talent and attract the best new talent.

According to this U.S. Chamber of Commerce article published on June 3 of this year, there is still a massive employee shortage facing businesses today. In fact, according to the article, even if every unemployed worker filled an empty job, there would still be 5.4 million jobs left vacant. That is a staggering statistic and might explain why current recruitment strategies have titles like “Winning the War for Talent” and why why “quittok” went viral this year.

This gap in the workforce has put a greater need for owners and hiring managers to create enticing benefits packages that bring in top talent and retain skilled workers, all while still benefitting the company. One way to do that is to utilize fringe benefits that don’t have to be declared by the employee for tax purposes and are often still a write-off for the employer.

Fringe Benefits: What they are and why you need them

Fringe benefits are additions to a salary that can supplement a worker’s pay.

Most fringe benefits ARE taxable, but there is a specific list of exclusions. That is where we will be concentrating. Most of this information can be found on the IRS website, but we’ve included a handy downloadable PDF for you to reference.

Meals

Providing meals on-site is not only a great way to provide a benefit to your employees, but it can also increase productivity. By not forcing your employees to leave for meals, they can save money on gas and food.

Arranging for food delivery can be really simple when you partner with a local business that is invested in your success. We gathered some resources for you so you can start right away.

Athletic Facilities

While there are restrictions on what you can use as a write-off, adding an on-site gym or athletic facility is a pretty easy one. You can’t use the gym to make money, and its use can be for the general public, but it is a fairly straightforward addition to your employee benefits.

Commuting Benefits

Offering commuting benefits can be one way to encourage employees to return to the office. The limitations on this benefit are probably the most detailed, and reaching out to your CPA to ensure you are meeting those restrictions is a good idea for any fringe benefit to ensure you and your employees are able to take advantage of them while still keeping them tax-free. We’ve included a list of CPAs for you at the end of this post if you need professional help.

Despite the restrictions on this benefit, it is one that we feel is worth the effort to research. Gas prices are a concern for many Americans right now, and so is sustainability. You can address both of those concerns with this benefit by offering benefits like commuter highway vehicle fares, mass transit passes and/or parking.

Education Benefits

Providing education benefits that are tax-free for your employees benefits your employee and their family as well as you as the employer. These benefits can include books, tuition, fees and supplies. While there are some restrictions on this category, it is one of the easier to navigate and provides a massive payout for everyone.

Professional Help

Sometimes, the best way to maximize your benefits package for your employees and ensure you are meeting all the requirements the IRS has put in place is to utilize a professional. Having a CPA or accountant helping you well before tax time can not only make submitting taxes easier (and often cheaper to file), but it also ensures you get your maximum write-offs and maximize your other benefits, like employee benefits packages.